Bryan Gildenberg's 2025 “Keyword” Predictions (Powered by AI)

How 5 Big Marketing Themes + 5 AI Concepts Will Fuel 2025 And Beyond

Welcome to the Confluencer Commerce 2025 predictions document, produced in partnership with SmartCommerce and its clients… whose inputs into the commerce world of 2025 acted as “training data” for this AI-influenced prediction model! You’ll see results from the GroceryShop participant voting throughout the narrative.

This piece looks at 4 major themes for 2025 arising from SmartCommerce client feedback and looks at them through the lens of a “keyword” – the core ones are:

Retail Media – specifically, the arraying of retail media into distinct tiers

Personalization - transitioning from blunt personalization to contextual relevance

Scale - its resurgence as a competitive advantage

Impulse – the expansion of “impulse shopping” to “reactive commerce”

AI - the evolving role of AI in business strategy

And because AI will be such a big part of the world of 2025 and beyond, we attached each keyword to a concept in AI training to highlight the opportunities attached to each 4 of these concepts.

We are forecasting a 2025 in which retail media evolves, personalization is slowly replaced by context as a critical enabler to relevance, where economies of scale are re-understood and where AI is harnessed to drive business forward. Hope you enjoy the read!

Retail Media (too generic)

Prediction: 2025 will see retail media separated into tiers:

Amazon is a multi-channel performance marketing platform best compared to Meta or Google,

Walmart and Kroger are national media entities,

The rest are managed in a way that looks more like traditional shopper marketing than Google or Meta.

One of the biggest problems in AI training is when the language it is learning is too generic – where there’s not enough specificity to the terms. According to Perplexity, the risks of “over-generic” learning are:

Increased ambiguity – a term meant to clarify makes the problem less clear

Decreased interpretability – “Vague terms make it harder to explain the model's decision-making process, impacting explainability and transparency”

Potential for bias – for retail media there remains deep concern about the whole process of measuring effectiveness and how “transparent” that process is

Reduced model performance

If this does not sound like the state of retail media today you are selling it, not buying it.

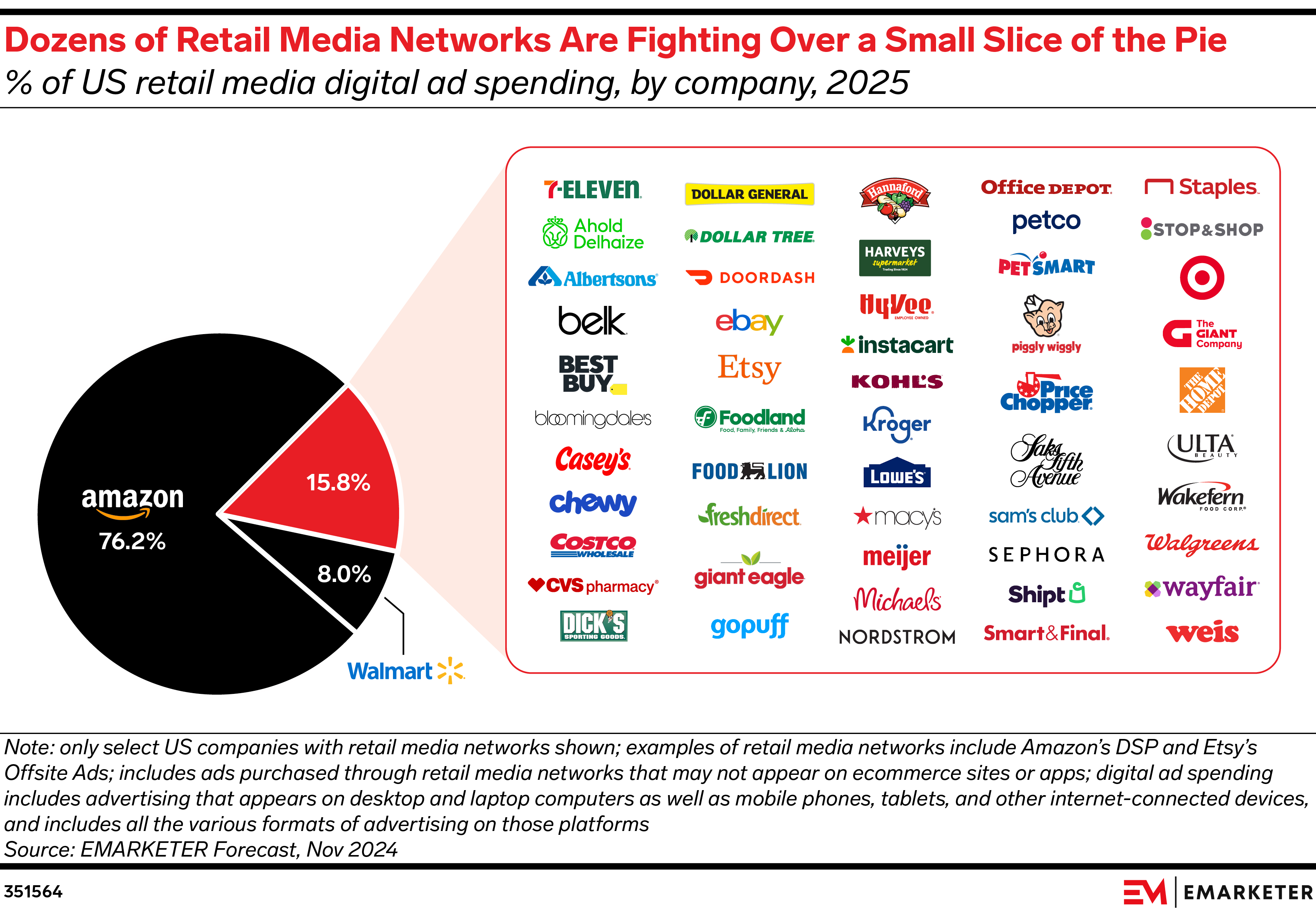

Starting with the definition of “retail media” - yes it will be $130 billion in the US in 2028. But, over 75% of this will be Amazon, and a huge chunk of the remainder will be Walmart (more on retail’s hyperscalers later).

This chart from eMarketer looking at 2025 tells this story simply and elegantly. Put simply, retail media outside of Walmart and Amazon is a $20 billion ecosystem with literally hundreds of platforms. This is neither efficient nor sustainable, and without a rethink will lead to years of muddled strategy and suboptimized spending.

What this suggests is probably at least a 3-tier approach to retail media –Tier 1 - Amazon (not retail media at all – really search media) and Tier 2 Walmart and “The Kroger Family of Companies”.

The key observation here is for everyone else:

To the degree that these are bought as media assets they will need to be sold through an integrated platform – commercial self interest will force these RMNs to become more standardized in their approach to programmatic building blocks like term definition and attribution frameworks. 3rd parties (who all stand to profit from this too) will lean in to make this work.

Think of retail media marketplaces like mall owners – no matter how distinctive the operating/labor models are of different in-mall retailers 95% of them open and close at the same time….it creates too much user friction to do it differently.

To the degree they are bought as standalone assets their primary value will be sold as part of an integrated media/shopper/selling plan aimed at maximizing demand solely within that retailer’s ecosystem.

For brands, mid-tier RMN management will be an attribute of shopper marketing teams – most of the value of these assets will be in maximizing sales within that retailer’s ecosystem and the people at a brand that care most about that outcome are the team charged with growing that retailer’s business. Retailer-focused shopper teams will use these upper/mid-funnel assets to achieve a portfolio of brand and commercial outcomes like they use the tools of shopper marketing today.

That means mid-tier RMNs need an ad platform that is a. Easy to use b. Relatively transparent c. Integratable into a commercial plan d. Capable of holding a long-term planning approach – optimizing a commercial plan requires longer time horizons and a retail media network needs to facilitate this type of long-term planning.

Personalization (because it’s “polysemous”) – Contextualization

Prediction: “Personalization” gives way to “relevance” as a guiding principle for advertising and that relevance may be more often achieved through context than through personalization.

An AI term we’ll hear more of in the coming years is “polysemous” – basically a word that can mean very different things depending on its context. Ironically, one of those words - personalization – is the word that reflects the rise of context as the new way to understand how to deliver the best combination of marketing relevance and value-additive user experience.

Personalization today is largely rooted in recommendations and content surfaced to an individual based on their previous behavior. And for certain purchase occasions this type of insight is powerful.

However, our prediction for 2025 (as this handily won SmartCommerce’s “hottest marketing trend of 2025 vote at GroceryShop) is that it is the year of Contextual Commerce – and that this will manifest in three very specific ways:

Contextual Conversion - Targeting people based on where they are and what they are doing not who they are and what they have done. In particular, expect assets like mobile location data to play a much more powerful role … the entry into a physical store, for instance, is like knowing someone has clicked on Amazon.com – except they are likely checking their phone and there’s an extended period of time (longer than a nanosecond anyway) where they can be reached.

Contextual “Funnel” Content - Understanding where they are in the funnel at a specific moment in time – knowing whether someone is relaxing, pursuing an interest,experiencing a need, bored and needing excitement, or actively in decision-making mode will be essential as more and more of those usage occasions take place on the same platforms like TikTok.

Contextual Solutions-Centric Content – Amazon’s recent announcement of its COSMO AI enhancements to its core search engine are the perfect entry to 2025 being the year of contextual content. Amazon will comb PDPs not just for keywords but for commonly observed product use cases, occasions and potential uses and feed those through an LLM to get to a refined, content-based search output.

Scale (Experiencing Semantic Drift)

Prediction: Scale is back. Large retailers have massive capital deployment and ecosystem liquidity advantages vs. small ones, and small stores will be increasingly displaced by large stores solving multiple shopper problems and driving eCommerce.

Semantic Drift in AI terms is what happens when a term’s meaning in usage and culture changes. Within commerce, this year’s term whose change will continue to be most significant is scale. In the Retail media conversation above we talked about the need to separate Amazon and Walmart from the rest of the “retail media” pack – is because the difference in degree (size) actually creates a difference in kind.

It's worth noting that for a while, cloud computing had reduced the advantages of scale in the analytics/software-centric world, and this disintermediation gave rise to conversations about “diseconomies of scale”- how big retailers (especially brick and mortar ones) may suffer by not being as nimble as their smaller competitors.

But … 2025 should see a return in the retail world to an environment where scale, properly harnessed, confers massive competitive advantages.

The first scale advantage is in traffic/3rd party marketplace – ad bid liquidity. Today, retailers like Target are promoting the quality of their 3rd party marketplace in terms of curation, and from a shopper choice perspective that has value.

However, without the traffic to attract the right quantity of sellers, it will significantly reduce the profit potential of the 3P vendor network as there won’t be nearly as much bid velocity for the retailer’s on-platform ad assets. Simply put, it’s hard to have a second price auction without a multitude of bidders.

In general, a curated marketplace has to bring enormous differentiation to an underleveraged space that needs it, to generate enough traffic to be mission-critical to sellers.

The second is in AI – AI training in particular. As Amazon is doing within its own ecosystem today, there are competitive advantages to having more data to feed your AI learning models. Other things being equal, AI learns much faster and better with more data than less.

The third major advantage of scale in 2025 and beyond for retail is the potential for investment in physical technology that will automate core logistic and operational processes. A phrase that gets used to describe the massive tech companies scaling AI compute is “hyperscaler” – the companies that can afford the cap ex to build tech infrastructure well beyond what their smaller competitors can do. This hyperscaling should come to life in 3 main ways:

Distribution center automation – robots that pick, scan, store and move product

Store operations automation – this scale isn’t just as a total business but in velocity per store – there are many more tech/robotic solutions that make sense in a small store vs. a large one as the cost of deployment is offset by the velocity/building.

eCommerce delivery/route density – in addition to technology, this also provides a stronger business rationale for mergers and acquisitions just in time for a new Federal Government and, probably, a new attitude from the FTC/DOJ. 2025, as a result, should be a year of intensified consolidation/M&A. This prediction from GroceryShop in our “who will merge with who” section makes real sense and it would not be surprising to see Instacart and Uber come together for both technology and route density scale advantages.

The three points above are all problematic for retailers running small store formats like c-store, drug and value/dollar (regardless of enterprise size). These stores will need significant merchandising, marketing and operational innovation to avoid losing significant market share in a “scale is back” world.

This consolidation isn’t just in the retail space – the recent announcement of Omnicom’s acquisition of IPG shows this “hyperscaler” mentality applies to service providers as well. As Omnicom CEO John Wren commented to investors regarding the acquisition in the world of 2025 scale isn’t a barrier to agility, but an enabler of agility:

“Yesterday I had $1 to invest in those efforts (technology and AI). Today I have $1.67 – it should make me more agile, and should make me take greater investment risks testing new technologies and platforms as they come out”

One last thought on mergers – watch the unfolding situation with cable television networks – in late 2024 Comcast was looking to spin off its networks into a new “SpinCo” which might prompt other companies like Viacom or Warner Bros/Discovery to do the same. Discovery’s assets (Food Network, Travel Channel, HGTV, Oprah Winfrey’s network and MotorTrend in particular) would be VERY interesting as part of a retailer (now THAT’S a retail media network!) … do not be stunned if Amazon or Walmart end up in the cable television business in 2025.

“Impulse” Everywhere, but Particularly from Content

Prediction: “Passive Commerce” begins joining “Impulse” as a critical shopping driver

This contextual commerce and scale concepts above together have one specific implication for the future of “impulse” in retail but it starts further “up the funnel” with content consumption.

Looking at what clients thought was the most important ad platform of 2025 is illuminating here – for all of the conversation around retail media networks, CTV and Amazon, the two platforms that were far and away the favorites among the GroceryShop voters were TikTok and YouTube.

The critical implication here is that advertisers are increasingly gravitating towards ecosystems that are not native to commerce. Historically “impulse” has relied on a trip to a physical store or a direct purchase from content designed to sell.

Leaning in on TikTok and YouTube and “commerce”-ize them is almost a matter of producing content that’s “pre-convenient” – solving for a need state before someone is in active shopping mode.

This pre-shop phase of algorithmically powered content immersion is a powerful one to harness – and as YouTube and TikTok’s platform (as well as Meta’s properties) allow more active targeting of search terms and individual viewing patterns

In short, commerce will be more embedded into engaging content experiences but not with commerce as the central focus – pre-shop commerce enablement is best thought of as “passive commerce”, and platforms that can harness this conversion opportunity across a range of active content engagement ecosystems are well positioned to win the future.

AI (dilution without specificity)

Prediction: AI begins to stand for “All-directional Integration” as teams realize its power for “horizontal” and “vertical” connectivity

Unsurprisingly, our audience at GroceryShop identified a range of AI use cases as the “biggest tech advancement in 2025”!

But even in this small sample of specific examples there are 5 different “votes” for AI as an advancement, but with 5 wildly different use cases articulated for it – agentic AI, AI for creatives, GenAI in technology, AI for immersive ads and automation in general. This, in AI learning terms, is known as “dilution without specificity.”

Today, even Perplexity when asked about AI, responds: “’AI’ is often used as a catch-all term for various technologies, from simple automation to complex machine learning systems, causing confusion about its actual capabilities and limitations.”

Today, AI obviously faces some definitional issues – to that end some core principles will become clear over the course of 2025 as businesses all seek to deploy AI in a wide range of ways:

AI requires hygienic and harmonized data to be trained, not used. This will lead to two confusing and at first glance inconsistent conversations within companies about AI that are both right depending on where the problem sits in the AI value chain. To be trained, AI needs massive amounts of highly harmonized data sets – people responsible for this will be putting increased rigor on the types and structure of data your models ingest. Applications of AI are brilliant, at the other hand, on skimming across a range of data sets once taught and pulling insights together. This makes AI deployment a powerful horizontal integrator – being able to go across multiple data sets in multiple parts of your organization to draw learnable conclusions.

AI today is better at aggregating than creating – for all the fun of late 2022/2023 when we were all using AI to create amazing things from thin air, the real power of AI is its ability to learn. Generative (creating) AI is still a relatively new use case, but aggregational (learning) AI relies on principles that are decades old.

Deploying AI against a broad complicated set of seemingly unrelated data to learn is a powerful tool – one that will be essential to THE commercial challenge of the late 2020s – aggregating fragmented opportunity into scalable strategy.

A specific example – today people are trying to harness GenAI to create messaging for segments of the population….for instance making my brand communication for a Latino campaign more relevant to Spanglish speakers, second generation Latinos vs. first generation or the Cuban-American population vs. a more generic Latino population. A real opportunity for AI is not to try and produce this, but to aggregate on top of the influencers who already speak to these communities about your category/product and to simply learn from what is being done now. This vertical integration from fragmentation to scale will be an essential part of our work in AI.

AI itself is not an opportunity, it’s an opportunity to drive to business objectives – clearly defining what we want the tech to do is more important than understanding the technology.

AI may be more human than tech – many of the concepts used around AI deployment – learning, governance, a well-structured assignment, not overwhelming it with complexity too early in its learning journey, patience as it ramps up over time – sound more like the language used to describe a new team member than a technology implementation. The best companies harnessing AI will be the ones thinking about it not as a replacement of their team, but as an essential new team member that makes the whole team better.

Conclusion

The key to all of these predictions is, essentially, a revisiting of words and concepts used on a regular basis and reconceptualizing them for an AI powered world.

Retail media as a term has become so broad that its usefulness is coming into question – most retailers will not be a smaller version of Amazon but omnichannel self-contained selling ecosystems, and structures and budgets will need to be managed accordingly

Personalization will morph into “contextualization” – with relevance being the critical measure of success

Scale is back – capital deployment and automation fuel agility

Impulse – “passive commerce” is the greatest source of incremental profit for brands and retailers

AI – this technology is a new teammate as much as a new tool